irs child tax credit tool

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. Enter Payment Info Here tool in.

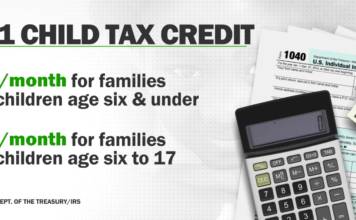

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

The IRS will pay half the total credit amount in.

. WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility. Fearing filing season chaos IRS hits pause on web tool for Child Tax Credit The decision has disappointed some advocates for low-income people who fear it. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. The 2021 Advance Child Tax Credit is fully. The form is located under the Resources section or simply click on.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. IRS opens online tool to register for the monthly Child Tax Credit payments Families who dont file tax returns can now register for the monthly Child Tax Credit CTC.

Finance tax. Ad Schedule 8812 More Fillable Forms Try for Free Now. And Made less than certain income limits.

IR-2021-150 July 12 2021. You must have claimed the Child Tax Credit on your most recent tax return or gave us information about your qualifying children in the Non-Filers. Update Portal helps families monitor and manage Child Tax Credit payments.

IRS Resources and Guidance Includes e-posters in other languages user. Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The IRS tax deadline for 2021 returns is April 18 for most states.

WASHINGTON The Treasury Department and the Internal Revenue Service today urged families to take advantage of a special online tool that can help them determine whether. IR-2021-130 June 22 2021. As the third payment is anticipated to be mailed out.

Child Tax Credit payments and Recovery Rebate Credits can make delay refunds. View the Child Tax Credit. You can download this form from our 2021 Child Tax Credit Advance Payment Option Get Help page.

IRS Child Tax Credit Non-filer Sign-up Tool Helps you report qualifying children born before 2021. The tool was created in order to help those who do not ordinarily owe federal income taxes register for the child tax credit. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number.

The first child tax credit payment was sent on July 15 and the second was sent on August 13. WASHINGTON The Internal Revenue Service today launched two. Advance Child Tax Credit Eligibility Assistant.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed.

Five Facts About The New Advance Child Tax Credit

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Irs Issues Child Tax Credit Faqs And Online Non Filer Tool

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

You Can Get 1 800 Per Child In Child Tax Credits Next Month Here S How

Irs Child Tax Credit Payments Start July 15

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Child Tax Credit Update How To Change Your Bank Info Online Money

Child Tax Credit Portal Why Is The Irs Closing Its Ctc Tool Marca

Child Tax Credit What We Do Community Advocates

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Here S What You Need To Know About Child Tax Credit Payments The Washington Post

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit Schedule 8812 H R Block

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wbff