child tax credit portal update dependents

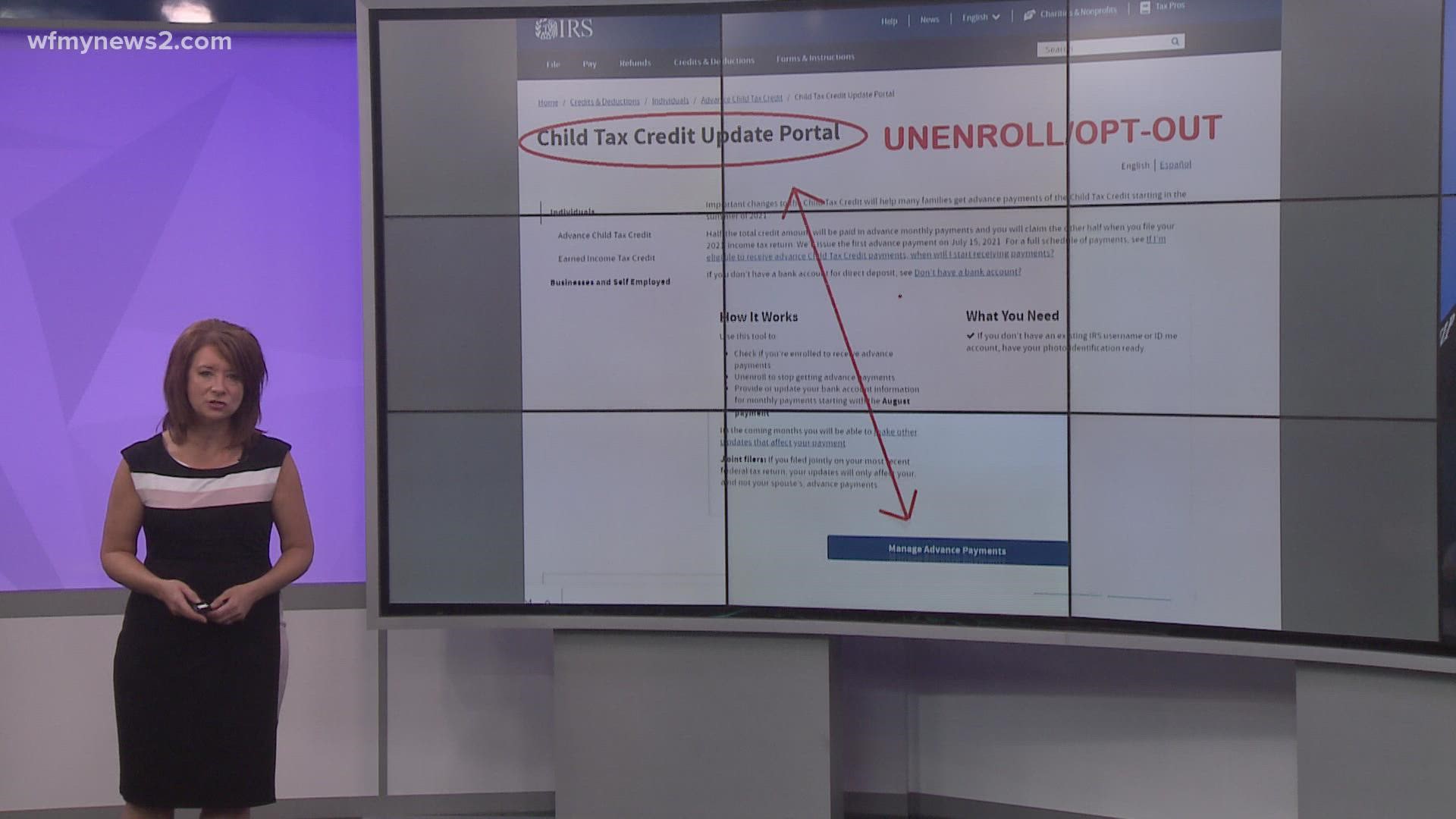

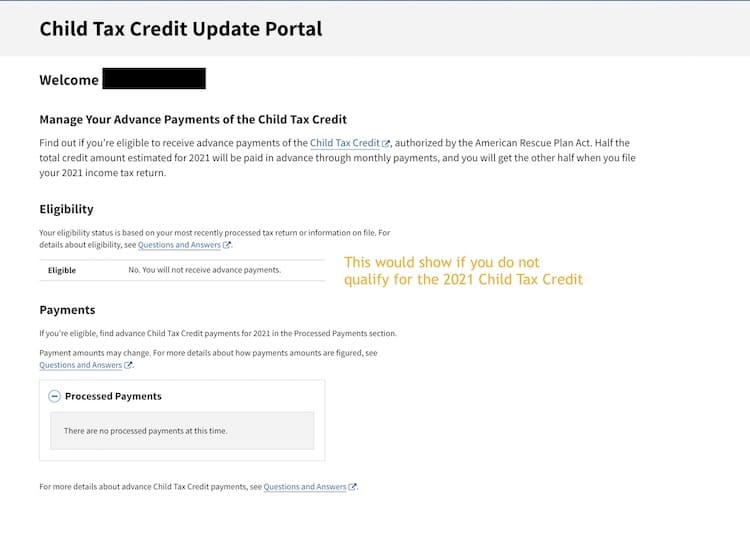

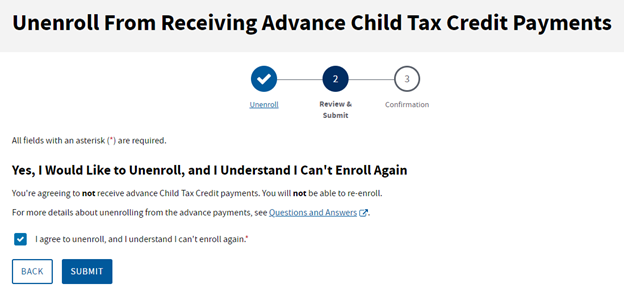

The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving. The updated information will apply to the August.

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

STOP You cannot take the child.

. Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax. Child tax credit portal update dependents. Child tax credit portal update dependents.

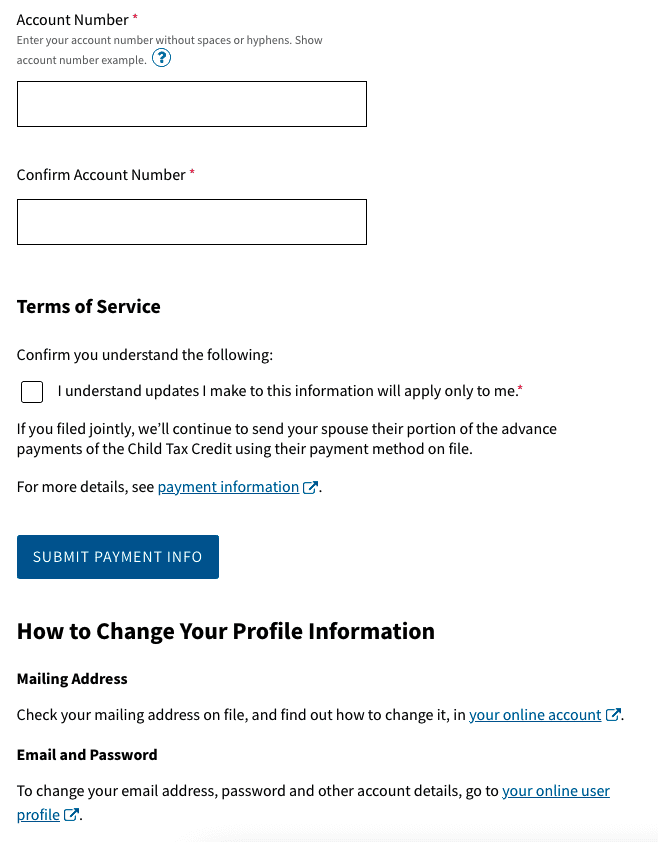

The Child Tax Credit Update Portal now also allows users to add or modify bank account information for direct deposit. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December. If you havent filed a tax return before or dont file every year and are eligible for the Child and Dependent Care Credit be sure to file to receive the credit this year.

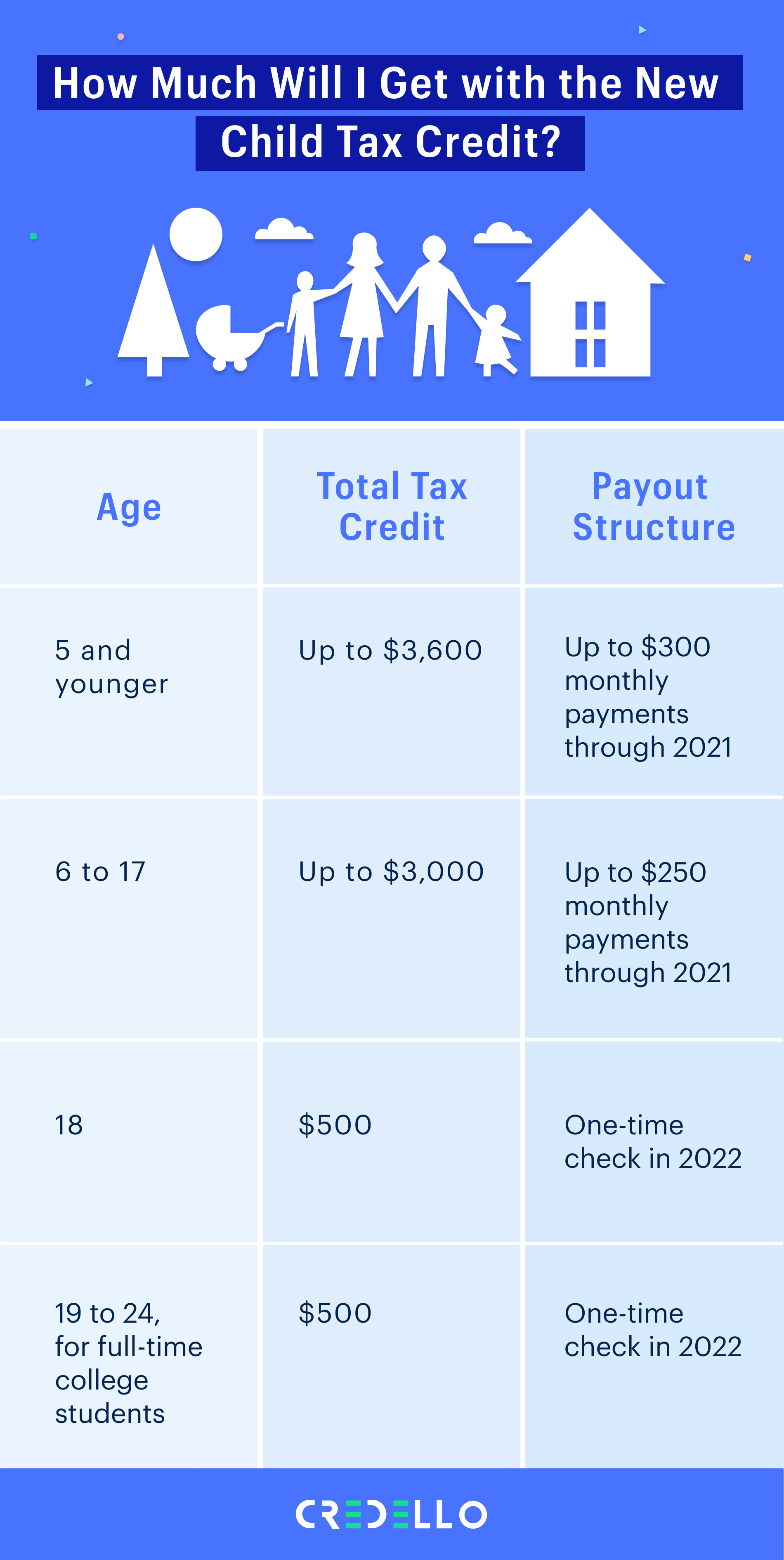

File Federal Taxes to the. A childs age determines the amount. You can file a 2021 tax.

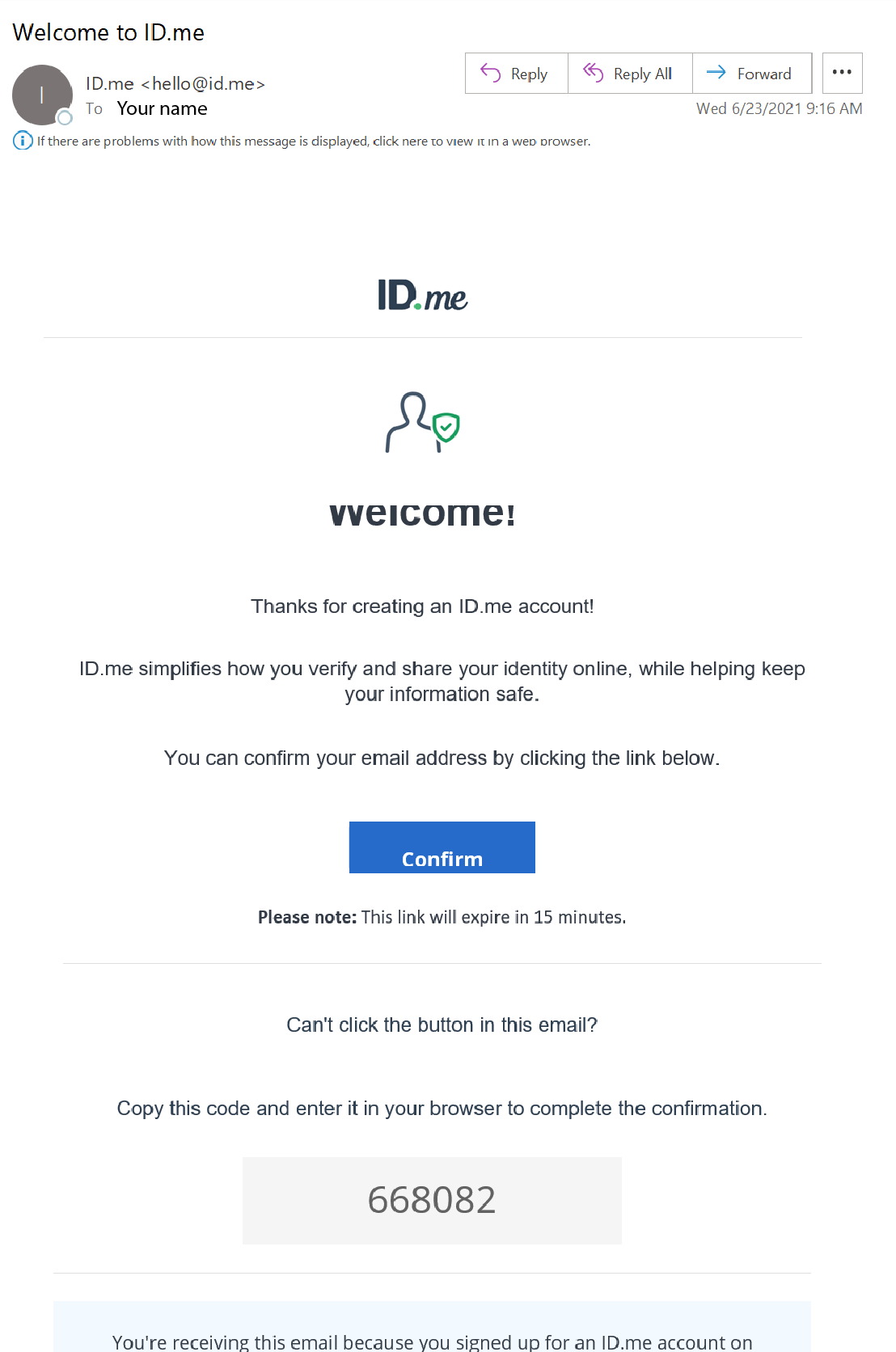

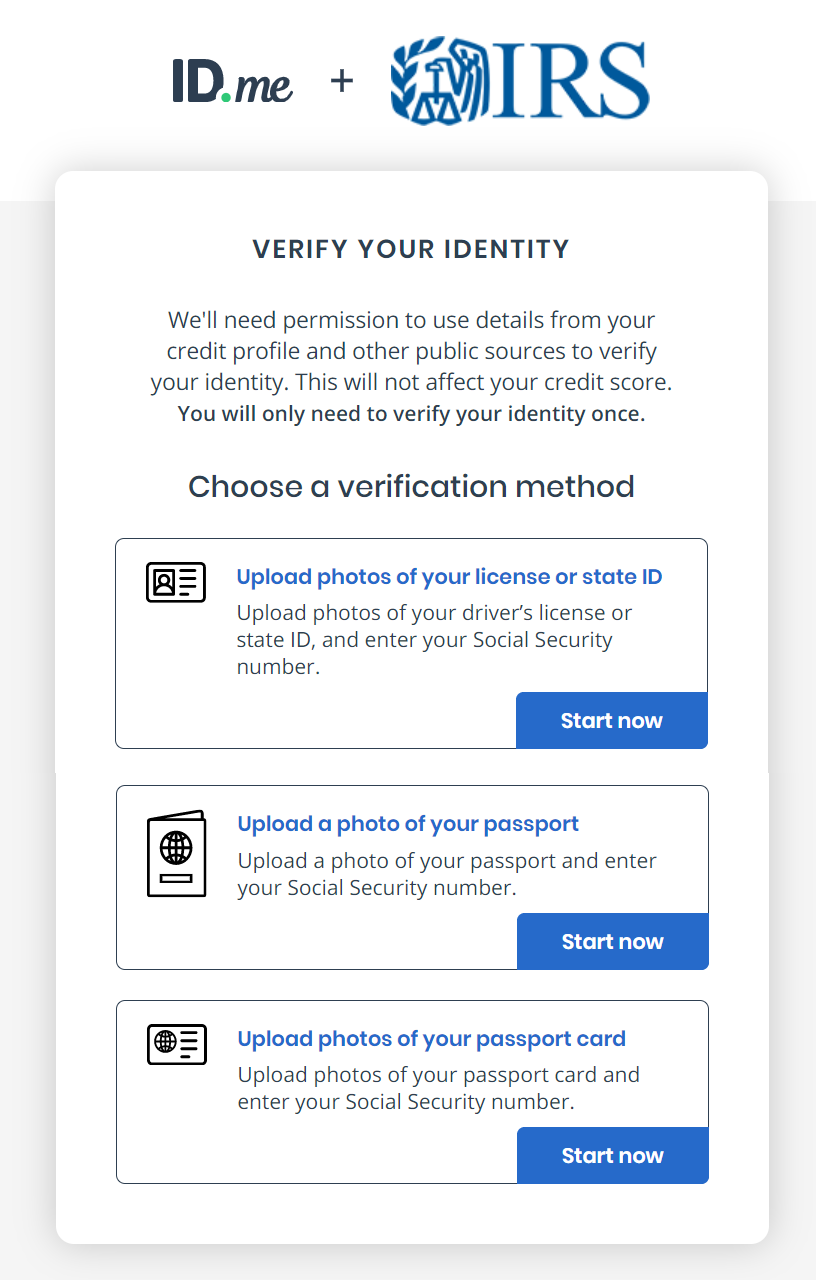

Filed a 2019 or 2020 tax return and. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Two portals designed specifically for child tax credits will be up and running by July 1 to help individuals update and adjust their personal financial information and any.

The 2021 child tax credit was temporarily expanded from 2000 per child 16 years old and younger to 3600 for children age 5 and younger and to. Heres how they help parents with eligible dependents. 5The individual does not file.

At some point the portal will. COVID Tax Tip 2021-167 November 10 2021. The American Rescue Plan which I was proud to support expanded the Child Tax Credit to provide up to 3600 for children under the age of 6 and 3000 for children under the.

Child Tax Credit Update Portal Learn about advance payments of the Child Tax Credit. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall.

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. For 2021 eligible parents or guardians can. By fall people will be.

In 2022 they will file their 2021 return report the. The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child. Have been a US.

Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account. The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. Soon people will be able update their mailing address. The IRS will pay 3600 per child to parents of young children up to age five.

4The individual is properly claimed as the taxpayers dependent. 5The individual does not file a joint.

2021 Child Tax Credit Steps To Take To Receive Or Manage

You Got Your Last 2021 Advance Child Tax Credit Payment Now What Don T Mess With Taxes

Final Child Tax Credit Payment Opt Out Deadline Is November 29 Kiplinger

Millions Of Families Received Irs Letters About The Child Tax Credit

White House Unveils Updated Child Tax Credit Portal For Eligible Families

2021 Child Tax Credit Steps To Take To Receive Or Manage

Married Couples Must Unenroll Separately From Child Tax Credit Wfmynews2 Com

2021 Child Tax Credit Steps To Take To Receive Or Manage

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Updates Letter 6419 Change Deadline Aug 30 Etc Gg Cpa Services

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

Child Tax Credit Payments What S Next

Child Tax Credit Update Irs Launches Two Online Portals

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Fourth Stimulus Check News Summary 14 August 2021 As Usa

Child Tax Credit Payments From Irs For 2021 Starting

What The New Child Tax Credit Could Mean For You Now And For Your 2021 Taxes Pressrelease Com